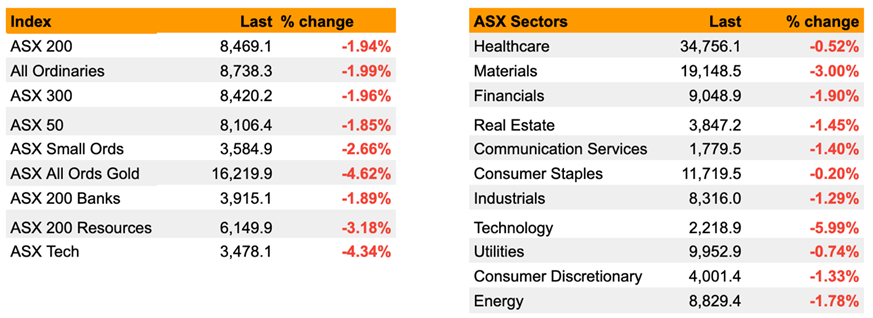

Looking at the Australian sector performance, it was a sea of red ink. All 11 broad sectors finished in negative territory. Technology led the carnage with a devastating -6% decline, extending the sector’s monthly losses. Materials fell -3%, while Financials shed -1.9%, which looked overdone. Whenever we get these two heavyweight sectors both falling on the same day, the benchmark is going to struggle.

The correction that originated last month with the ASX200 index hit (and overshot) the top of the 20-year-long established trend channel, and is now well advanced. Our view is that this correction is drawing closer to an end and will soon “run its course”, with key support below near 8,150/8,200 likely to put in a floor.

Our base case remains for upward momentum and the bull market to soon reassert in December following a correction (that has drawn down around 7% from the record highs).

Within materials, even gold didn’t offer a place to hide, with the All Ords gold index down -4.6% as gold lost recent upward momentum. On the defensive end, Consumer Staples held up best with a marginal -0.2% slip, while healthcare fell -0.5%, offering little consolation in a firmly downbeat session.

Technology plunged -6% to extend what has become a brutal month for the sector, now down around -20% over the past four weeks (with most of the damage in November). Technology One tumbled -17.2% after annual recurring revenue for 2025 missed forecasts, and the final dividend was given a trim. The shift to a SaaS+ business model is currently compressing margins, though it is expected to benefit shareholders over the medium term. WiseTech Global sank -4.6% to a two-year low while Xero fell -3.25%. The sector was littered with red ink, including NextDC -5%, Megaport -3.9% and Life360 -4.2%.

Next in the firing line was the materials sector. Diversified iron ore majors all retreated, with BHP down -3.7%, RIO off -2.65%, and FMG shedding -2%, even as the steelmaking raw material held relatively firm. Gold miners were weak as bullion drifted lower. Among large caps, Northern Star led the decline at -5.6%, Evolution Mining dropped -5.2%, while Newmont declined -2.7%. Small and mid-caps followed suit, including Rox Resources -7.9%, Falcon Metals -6.8% and St Barbara -6.7%, among others. The All Ords Gold Index tumbled -4.6%, reflecting the sector-wide retreat. Copper exposures fared no better. Sandfire fell -3.8% and Capstone Copper slipped -3.65%, while 29Metals slumped -8.05%. Some lithium stocks bucked the trend, including Pilbara Minerals and Liontown +2.1%.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.