On track to hit the top end of 2021 guidance

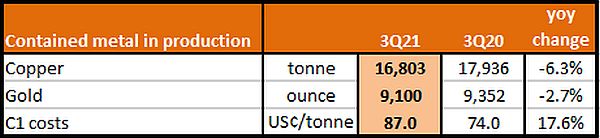

Sandfire Resources has released its third quarter operational results, reporting a fall in its headline production numbers for the quarter and a rise in costs. Production guidance for 2021 was maintained, with Sandfire’s expectation of reporting toward the top-end of the range and it did provide an upgrade on cost guidance numbers for 2021. A snapshot of the balance sheet revealed no debt and a swag of cash. The following table is a summary of Sandfire’s March quarter operational results:

Source: Sandfire Resources

Overall, the March quarter result was, in our view and at best, a satisfactory one, with our view espoused on the positive changes to 2021 guidance numbers. Meanwhile Sandfire’s very strong balance sheet remains a key attraction.

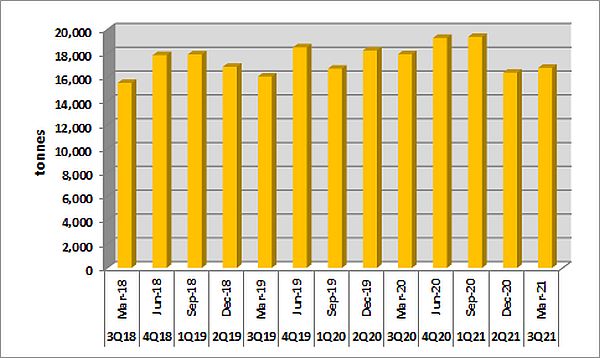

The DeGrussa (Sandfire’s interest 70%) and Monty mines in Western Australia are Sandfire’s producing sites. As Members can see from the above table, copper production fell by 6.3% year-on-year (yoy), to 16,803 tonnes of copper. The following chart shows quarterly copper production:

Source: Sandfire Resources

A fall in the copper grade of milled ore to 4.6% copper compared to 5.0% from a year earlier was the key driver of the result. A partial offset was the reported rise in milled ore throughput by 3.4% yoy, to 395,671 tonnes on improved efficiencies. Both the DeGrussa and Monty mines deliver to the same processing plant.

Copper guidance for 2021 remained unchanged with a forecast in the range of 67,000 tonnes to 70,000 tonnes. A standout feature was Sandfire indicating that it expects copper production to come in toward the upper end of its 2021 guidance band. For 2020, Sandfire produced 72,238 tonnes of copper.

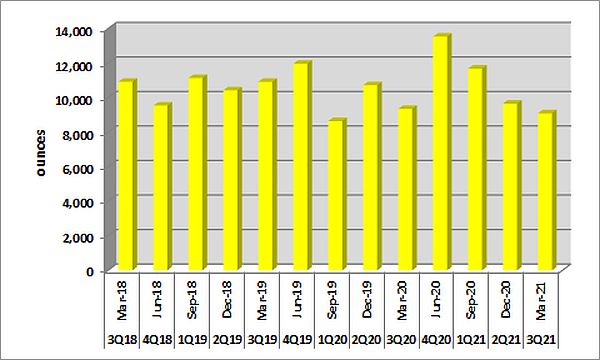

Gold production for the March quarter also fell, but by 2.7% yoy, to 9,100 ounces. The following chart shows quarterly gold production for the DeGrussa mine:

Source: Sandfire Resources

A lower milled gold grade was the primary driver, with the March quarter result reporting a grade of 1.5 grams per tonne (g/t) compared to 1.7g/t gold from a year earlier. Sandfire did however reiterate its 2021 guidance to be in the range of 36,000 to 40,000 ounces of gold. Sandfire expects gold production to come in at the top end of its 2021 guidance band. In 2020, Sandfire produced 42,263 ounces of gold.

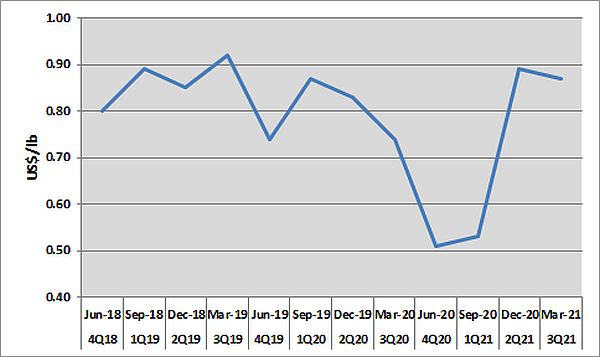

Operating costs got an unpleasant boost for the March quarter. The following chart shows quarterly C1 costs for the DeGrussa mine (lb – pound):

Source: Sandfire Resources

C1 cash cost for the DeGrussa mine reported a 17.6% jump yoy, to US87 cents per pound. Primarily on the fall in copper production for the quarter, costs came in higher.

Guidance for C1 cash costs in 2021 has however been upgraded and is forecast to be in the range of US80 cents to US85 cents per pound, from the previous US85 cents to US90 cents per pound. Forecast upper end production for both copper and gold is the primary driver in Sandfire resetting costs lower. The upgrade is the standout feature from the March quarter result.

We have a positive view on the copper price over the remainder of 2021, as infrastructure spending stimulates demand. A weaker US Dollar will also, in our view, be a positive tailwind, as it succumbs to an increasingly leveraged US economy on rising US debt levels. Rising inflation will also increase the velocity of the tailwinds, as economic activity accelerates and creates supply chain bottlenecks.

A snapshot of the balance sheet, as of 31 March 2021, shows no debt and a cash hoard of US$463.6 million. The debt position from a year earlier was unchanged, while the cash hoard stood at US$242 million. We view the balance sheet as a sound platform to deliver future shareholder value from Sandfire’s extensive development and exploration portfolios.

We believe the DeGrussa and Monty mines and the significant acreage around them and an extensive blue sky exploration portfolio, are key factors in determining our view on Sandfire. Innovations in mining practices such as installing solar power, well ahead of the pack for the DeGrussa mine, are now fully bearing fruit and being reflected in Sandfire’s financials, are added considerations. A positive view on the copper price delivers the leverage.

Despite the rally in the share price, including the recent surge through A$6.00 to a tad over A$7.00, we believe Sandfire Resources is well positioned, operationally and financially, to retest new share price highs.

Consequently, our recommendation for Sandfire Resources as a buy for Members with no exposure remains unchanged.

Disclosure: Interests associated with Fat Prophets holds shares in Sandfire Resources.