1. Australia Market

The ASX 200 slid -0.33% on Thursday as traders digested another wave of corporate reports, with significantly more misses than hits. The benchmark opened underwater following a weak lead from Wall Street and Nvidia’s sharp fall in after-hours trading. The index fell deeper in early trading but enjoyed some buy-the-dip support in the afternoon to finish only modestly lower. Most sectors declined, and at the individual stock level, decliners outnumbered advancers by about 1.5 to 1 in the broader ASX 300. SPI futures are pointing to a 0.64% gain on the open.

Only three broad ASX sectors closed in the green, and not by much. Financials gained +0.32%, followed by industrials +0.28% and tech +0.07%. The three sectors that fell the most were energy -2.15%, consumer discretionary -1.95% and consumer staples -1.14%. Among the financials, the big four banks rose +0.2% to +0.8%, with further support from Macquarie +0.7% and Suncorp +0.7%, offsetting modest declines from QBE -0.6% and IAG -0.5%. Tech stocks were mixed, but advances from Wisetech +0.8%, and Xero +1.05% outweighed declines from NextDC -1.4%, Technology One -0.2% and Life360 -1.5%.

The energy sector fell sharply as Brent crude prices dipped below the $80 per barrel mark amid ongoing concerns about demand in China. Santos shed -2.7%, and Woodside Energy dropped -1.7%. Coal miners were also hit hard, with Whitehaven Coal and New Hope Corporation sliding -2.4% and -2.6% respectively. The uranium exposures had a tough day as traders punished Boss Energy -8.3% and Bannerman Energy -9.2% after updates. Paladin Energy’s -3.75% decline was modest in comparison.

A -4.1% slide from Wesfarmers dragged the discretionary sector lower despite reporting a higher 2024 profit and dividend. An impressive performance from Kmart offset weakness in its energy, chemicals, and resources businesses. Traders opted to take some profits off the table after an impressive upward run YTD as the valuation looks lofty. Meanwhile, online luxury retailer Cettire was another notable mover. The stock dived -20% after warning about soft trading and that the auditor has not yet signed off on its numbers.

Bega rallied +9.4% to a two-year high after the dairy firm returned to profitability. This was insufficient to rescue the consumer staples sector as Woolworths -2.4% and Treasury Wine Estates -1.9% fell. Reports from consumer-facing companies have been downbeat this week, which adds to my belief about the widening cracks in retail, which will push the RBA towards providing some interest rate relief before year-end.

The Materials sector slipped -0.67%. BHP edged down -0.6%, while Rio Tinto fell -0.8%, dragged lower by softer iron ore prices and broader market weakness. However, Fortescue managed a +0.7% gain. South32 also bucked the downward trend, adding +0.7% after delivering a robust FY24 result. The diversified miner beat earnings expectations and announced a dividend above consensus estimates. A $200 million share buyback was the cherry on the top.

The gold sub-index performed poorly, falling -1.1% despite firmer gold prices. The large caps were broadly lower, with Northern Star -0.5%, Newmont -0.3%, and Evolution Mining -2.1% in the red.

Red 5 was a drag, tumbling -12.3% after disappointing guidance. FY24 gold sales surged 35% to 223,498 ounces, underpinned by a surge from the King of the Hills mine in its second year of operations. The merger with Silver Lake was completed on 19 June 2024, so Red 5’s FY24 results only include 12 days of contribution from Silver Lake. Revenue jumped 47% to $620 million thanks to more ounces and higher prices, but Red 5 posted a statutory loss of $5.4 million due to one-off merger costs. Underlying profit rebounded to $48.5 million from a $1.5 million loss last year. However, the market reacted negatively to the company’s weaker-than-expected FY25 guidance, forecasting lower-than-anticipated gold sales and higher all-in-sustaining costs.

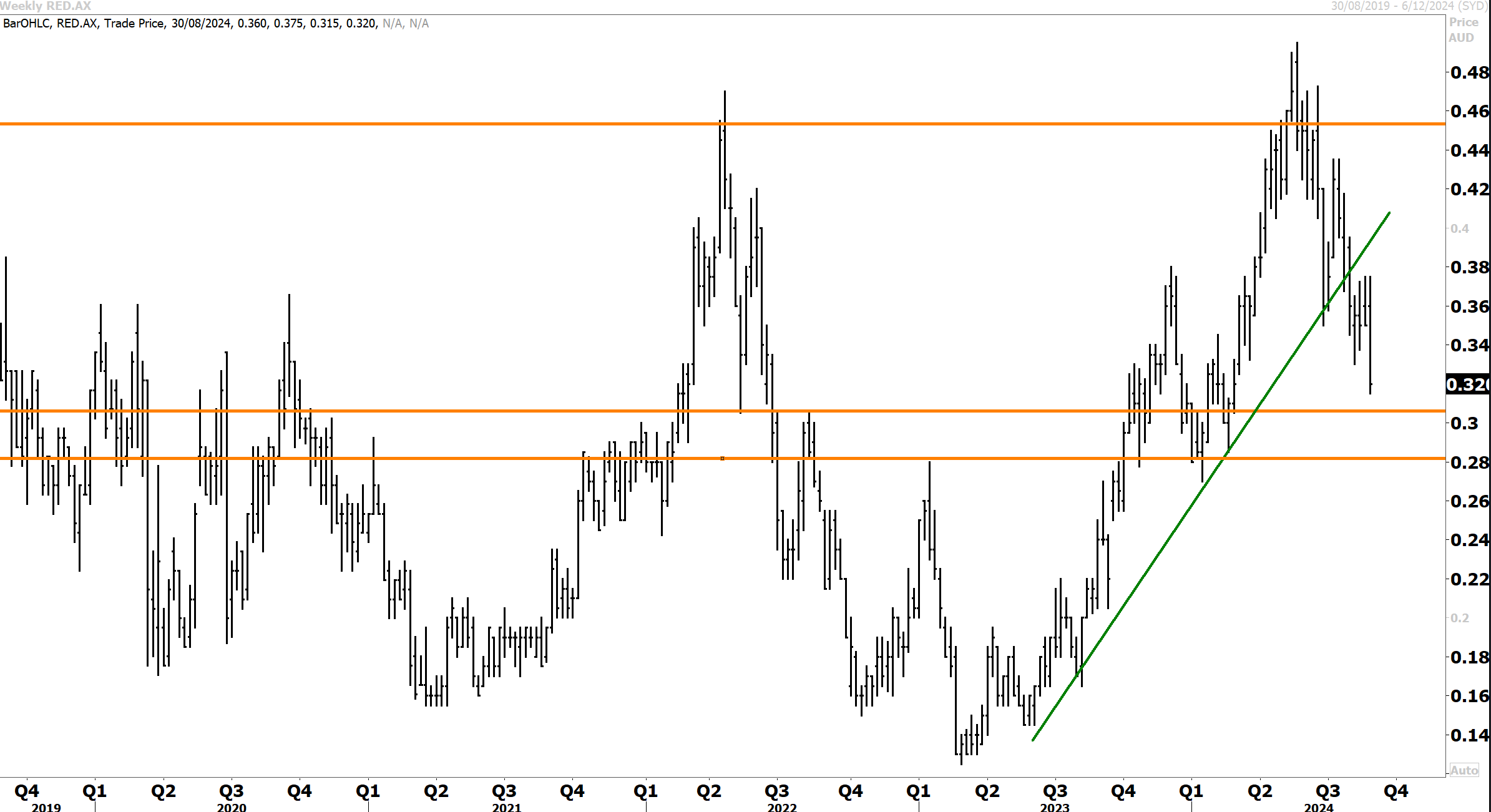

In our last technical update on August 1st, we highlighted that “Following the recent corrective pullback, Red 5 has found support at the primary uptrend and has reasserted itself on topside. A retest and eventual breakout above the 46c high remain the base technical outlook in the coming months.”

Resistance has proven significant above 46c, with RED 5 correcting sharply after breaking below the near-term uptrend and falling back towards support at 30c/32c. This support level is also significant and should hold the shares and provide the foundation for a decent recovery from oversold levels.

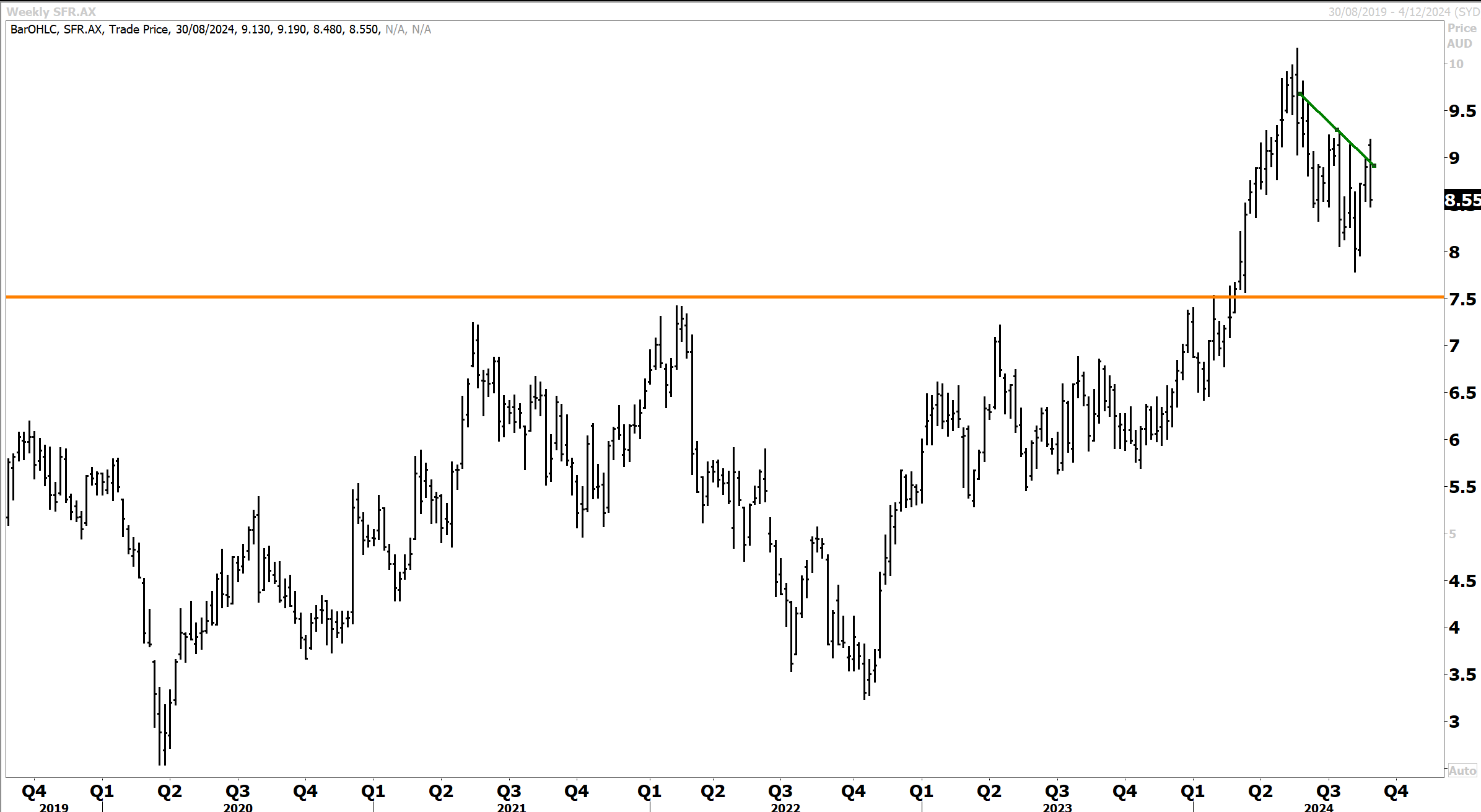

Weaker copper prices and overnight falls in peers dragged on Australian-listed exposures on Thursday. 29Metals retreated 2.8%, and Sandfire fell 3.1%. Sandfire had already pre-released significant information before

its FY24 results dropped on Thursday. FY24 numbers aligned with expectations, and the FY25 guidance was encouraging, leading us to expect solid underlying earnings growth again this financial year. FY24 sales increased 16% to $935 million while underlying EBITDA surged 40% to $362 million. Cost control impressed.

In our last technical update in mid June we noted that “Sandfire has broken out above the big overhead resistance level at $8.50. In recent corrective price action, Sandfire looks to have successfully tested this level as copper spot prices find support following a selloff. Once Sandfire has concluded the incumbent consolidation, upward momentum should soon be reasserted.

Sandfire remains in a consistent uptrend, which is encouraging given the corrective selloff in copper prince and broad-based decline in the copper mining sector. Sandfire is consolidating ahead of a likely resumption in upward momentum. A breakout above $9 would confirm this.

In other corporate news, Qantas managed a late session rebound, finishing +0.8% higher. It reversed early losses after confirming its plans to resume dividends next year. These will be the first dividends for shareholders since the pre-pandemic era. Webjet tumbled -5.6% after providing a lacklustre trading update at its AGM. Wagering group Tabcorp extended its losses, falling another -5.2% after already suffering a significant hit on Wednesday after a disappointing update.

Mineral Resources slumped -8% to a three-year low as it opted not to pay a final dividend, citing weak lithium prices. IGO defied the broader downtrend in battery metals, rising +1.3% despite halving its dividend and a sharp drop in full-year profits.

2. US Market

The S&P 500 closed flat at 5,591. The Nasdaq Composite lost 0.23%, while the Dow added 0.59%. The Russell 2000 added 0.7%. Nvidia lost 6.4% after quarterly revenue yesterday, which disappointed investors. It was a good result – but not good enough.

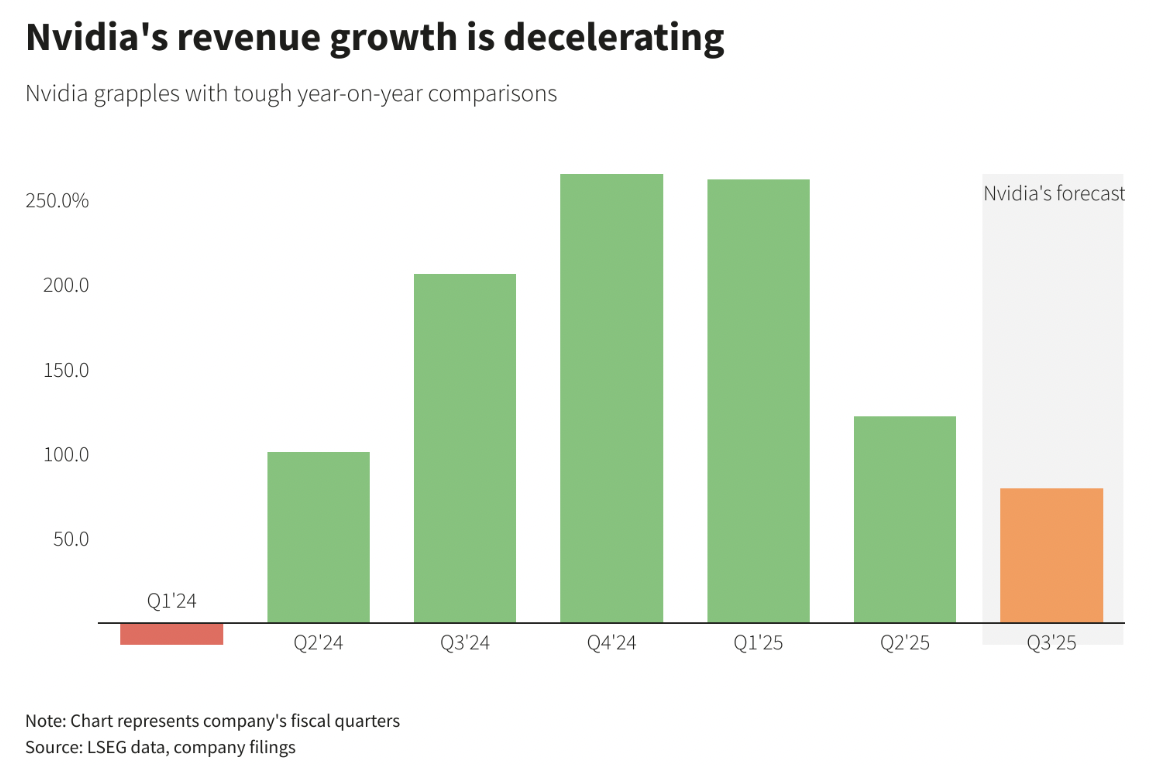

the steep fall from Nvidia -6.4%, accompanied by a -0.7% decline from Alphabet, more than offset slight gains from the other Mag 7 names. I covered Nvidia’s earnings report in yesterday’s correspondence. Summarising, it was another blowout quarter, but not to the same extent we had seen in previous quarters. Guidance was upbeat, topping the median estimate, but below the most optimistic forecasts and showing slowing top-line momentum, as this graphic from Reuters below shows.

Nvidia’s growth is still the envy of most companies. However, with the slowing growth rates, combined with some creeping doubts about when/if customers will reap financial benefits from their massive spending on Nvidia’s AI training chips, it is unsurprising that many investors opted to take some profits off the table.

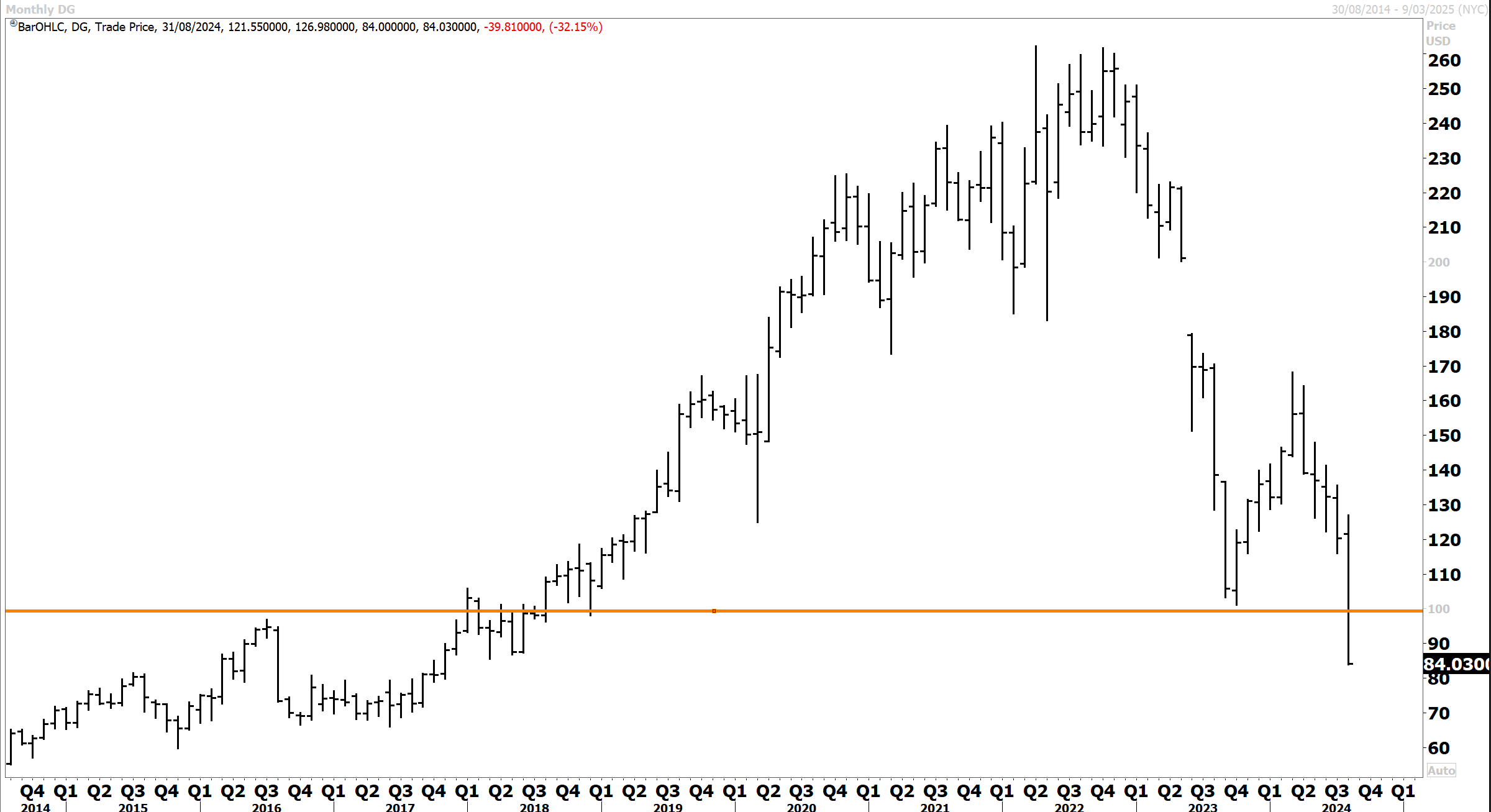

Discount retailer Dollar General took a nosedive, plunging about -32% after cutting its full-year sales and profit outlook. CEO Todd Vasos pointed to a “financially constrained” core customer as part of the reason for the slowdown. The second quarter results were a letdown. Competitor Dollar Tree wasn’t spared either, seeing its shares drop by more than -10% on the ripple effect.

With low-budget retailers such as Dollar General in trouble, what does that mean for the rest of the US economy?

BNPL player Affirm, on the other hand, had a stellar day, with its shares soaring roughly +32%. The buy now, pay later company surprised the market with a stronger-than-expected revenue forecast for the fiscal first quarter, projecting between $640 million and $670 million, well above the $625 million consensus.

Best Buy saw its shares climb around +14% after raising its earnings guidance for the fiscal year. The electronics retailer now expects adjusted earnings to fall between $6.10 and $6.35 per share, an improvement from the previous range of $5.75 to $6.20. The company also delivered better-than-expected results for 2Q.

Nutanix was another big winner, with its stock jumping more than 20% after the cloud infrastructure company outperformed expectations in the fiscal fourth quarter. Veeva Systems climbed nearly +9% after the cloud computing company reported a strong fiscal second quarter.

Crowdstrike advanced +3% after the cybersecurity firm posted better-than-expected quarterly earnings and revenue. However, after last month’s global outage, the company tempered enthusiasm by lowering its full-year outlook. The legal fallout remains to be seen.

HP Inc added +2% after delivering better-than-expected fiscal third-quarter revenue of $13.52 billion, topping the consensus estimate of $13.38 billion. However, its adjusted earnings of 83 cents per share fell short of the 86 cents analysts had predicted.

Okta had a rough session, with its shares plummeting over 17%. The secure identity cloud platform reported billings of $651 million, falling short of the $679 million consensus estimate. Bank of America left no doubt it was unhappy, double-downgrading the stock to underperform from buy. Pure Storage saw its shares tumble by -16% after the data storage company issued a disappointing third-quarter operating income forecast.

Birkenstock wasn’t spared either, as its shares dropped more than -16%. While the iconic sandal maker reaffirmed its full-year revenue guidance, forecasting around 19% growth, its fiscal third-quarter adjusted earnings failed to meet Wall Street’s expectations. Birkenstock IPO’ed in late 2023.

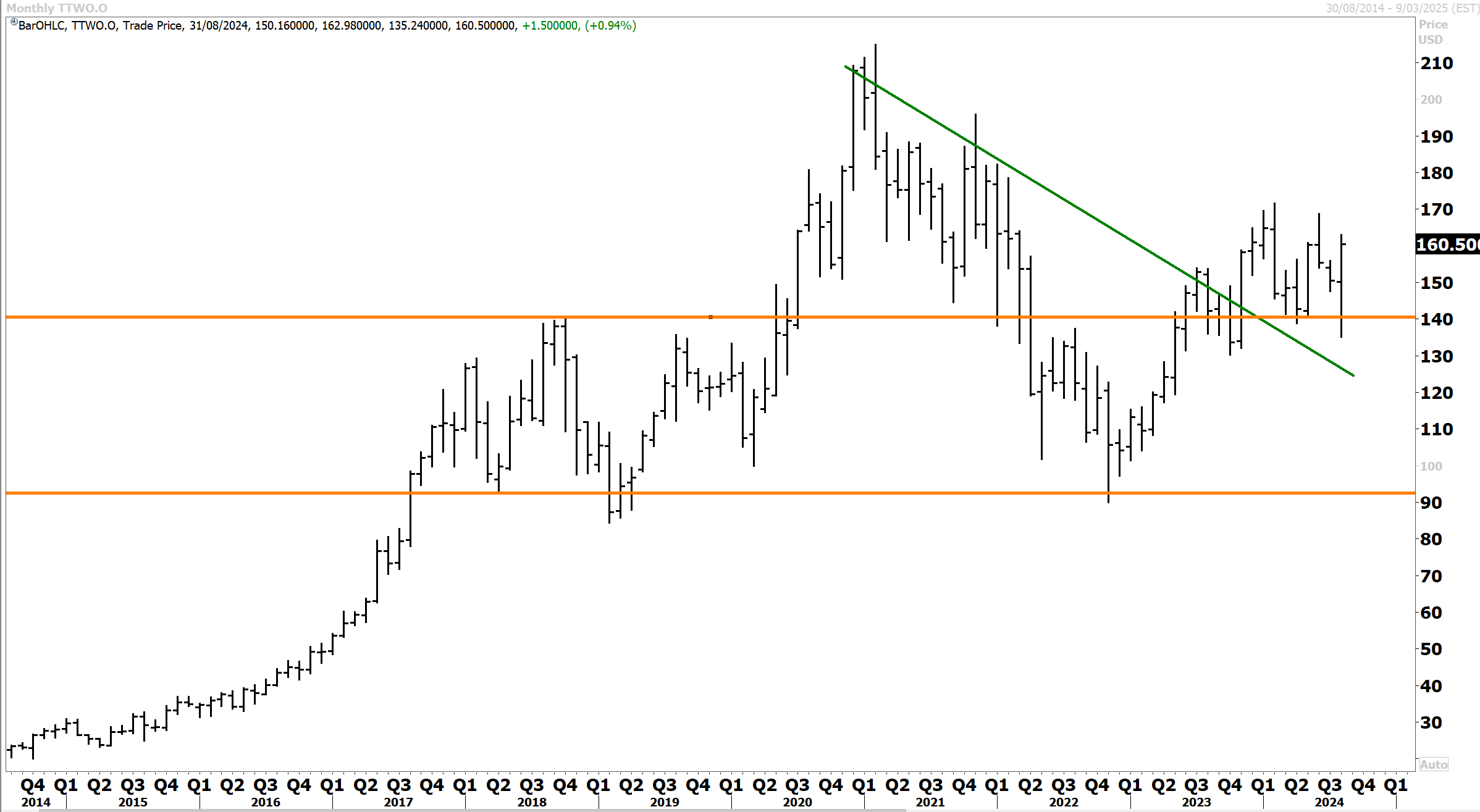

Take-Two Interactive shares added +0.9%. The video game developer and publisher has joined the layoff bandwagon, with media reports showing that the group has laid off game developers. This could delay the launching of key titles like the much-awaited GTA 6. That aside, the latest quarterly numbers beat analyst estimates.

In our last technical update on TTWO on June 30th we highlighted that “Since topping out above $210 in 2021 (when everyone played video games during the pandemic), Take Two subsequently corrected by over 50%, with the stock finding a bottom at $90. Over the past few years, TTWO has recovered significantly to test overhead resistance at $160. Once overhead resistance is successfully breached on the topside, TTWO will confirm an inflection, with scope raised for a further recovery over the coming year. A break below support at $130 would be bearish and increase the risk of further downside.”

Since our last technical update, TTWO has traded within a range between $140 and $170. The technical setup favours upside momentum returning and a breakout above $170 in coming months, with support at $140 consistently respected.

Data centre giant Digital Realty Trust -0.4% (US:DLR) reported a record 2Q24 with $164 million in new leasing executed during the quarter, increased occupancy, and completed a new acquisition in Germany while remaining under leverage targets. Funds From Operations, a key metric for REITS, tracked higher year-on-year to $1.57 (+3.2%), with dividends stable at $1.22. The REIT also recently joined forces with Blackstone to develop more data centres in major Frankfurt, Paris and Northern Virginia metropolitan areas. The REIT is leveraged to the AI boom.

While in a consistent primary uptrend, DLR has not surpassed the record highs above $170. This risks further consolidation that could open a decent buying opportunity. Support is prominent at the $120 level, with the stock likely to retest this level in the months ahead.

3. Asian Market

Turning to Asia, China’s CSI 300 declined -0.27%, while the Hang Seng advanced +0.53%. Hong Kong stocks shrugged off a shaky start, closing above water, supported by share buybacks and a positive update from Meituan.

A solid earnings report from the food delivery platform Meituan saw the stock melt-up +12.3%. Sales topped expectations, and 2Q profit more than doubled. However, the positive read-across for other tech stocks was limited. Sunny Optical +4.2%, Tencent +0.9% and Kuaishou Technology +0.8% advanced. Baidu -0.6% and NetEase -1.1% declined.

Li Auto skidded -9.8% after disappointing earnings highlighted the toll of an intense price war among the EV makers. Its peers also struggled, with Xpeng dropping -5% and Nio falling -4%. However, BYD Co, the world’s largest EV maker, rebounded from earlier losses to close +0.7% higher despite weaker-than-expected first-half profits. However, its affiliate, BYD Electronics, plunged 6.3%.

Mengniu Dairy jumped +9.7% after unveiling a HK$2 billion stock buyback initiative, becoming the latest in a growing corporate group jumping onto the theme. Most Hang Seng constituents have now reported, and profits have narrowly outpaced expectations, boosting earnings growth to above 9%. This is still not reflected in the broader market’s valuation, although we have seen some signs in August, with the Hang Seng on track to post its first monthly gain since May.

The yen traded in a narrow range of about 144 against the greenback. The 10-year JGB yield was marginally lower at 0.885%. Financial stocks were mixed, with SBI Sumishin +2.3% and Mebuki Financial +0.5% among the better performers in the group. At the other end of the spectrum, declines were shallow, with Daiwa Securities -1.2%, Mizuho Financial -0.6% and Resona Holdings -0.5% leading the losers.

Square Enix -0.2% reported a mixed quarter, with a notable 18.4% year-on-year drop in game sales despite the much-anticipated release of Final Fantasy 7 Rebirth, whose sales numbers remain undisclosed. While profits were buoyed by aggressive restructuring, including cancelling several development projects, the company faces pressure to deliver on its next big releases. Meanwhile, Final Fantasy 14 continues to be a bright spot, and the company’s strategic shift towards multiplatform releases, especially on Xbox, signals a potential new direction for future growth.

In our May 23rd technical update, we highlighted that “Since the earnings release, the downward dynamic has brought Square Enix close to the primary upward trend – which has been in place for close to a decade. The primary uptrend needs to hold. If support gives way, then scope would be raised for additional downside extension this year. Resistance at Y7200 is proving heavy and stubborn.

Square Enix has, to date, respected the primary uptrend and support at the Y4400/4800 level. This is encouraging and points to a resumption of upward momentum returning soon. A break below the primary uptrend risks only a marginal, deeper correction back to the big support at Y4000, which is also the historical breakout level.

Some leading performers included Osaka Gas +2.8%, NEC Corp +2.1% and Mitsubishi Heavy +1.95%. Daikin Industries dipped -0.8% despite the government report describing robust sales of air conditioners amid a heatwave. Online fashion marketplace Zozo -3.05%, SoftBank -2.4% and semiconductor heavyweight Tokyo Electron -1.8% were laggards.

4. UK Market

The FTSE 100 climbed by +0.43% to 8,379, benefiting from a rally in heavyweight multinationals, with some support from a weaker pound, while the more domestically focused FTSE 250 slipped by -0.17%.

Whitbread, the owner of Premier Inn, saw its shares rise +3.7% to near the top of the FTSE 100 table following Bernstein’s upgrade to ‘outperform’.Merchant bank Close Brothers +8.1% and specialist distribution giant Bunzl +2.7% gained after RBC Capital Markets upgraded their ratings, citing improved revenue and margin forecasts.

Centrica, the parent company of British Gas, added +1.5% thanks to a Jefferies upgrade to ‘buy’. CAB Payments added 4.8% as it struck a deal to partner with Visa, which will improve its ability to execute payments quickly.

IG Group Holdings slipped -2.5% after the company’s co-founders sold a significant stake to institutional investors.

Have a great weekend.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters.