The RBA meeting didn’t spark much change locally, as the cash rate stayed at 4.35%, as widely expected. Governor Michelle Bullock said that rate cuts were likely but only towards the middle of next year. I still believe that the RBA will go earlier, but this could be a February event.

The ASX200 wrapped up Tuesday’s session in the red, with the benchmark shedding -0.4% to 8,131. Traders maintained a cautious stance ahead of the highly anticipated US presidential election. Volumes were light with the Melbourne holiday and many traders were away from their desks watching the cup. Declines were broad-based on Tuesday but not steep. Fallers in the broader ASX300 outnumbered gainers by about 2-to-1. SPI futures are pointing to a 0.65% gain on the open.

The Reserve Bank of Australia maintained the cash rate at 4.35%, citing persistent inflation. Governor Michele Bullock noted that while inflation forecasts suggest a continued decline, the RBA needs more convincing before a pivot. She wasn’t drawn into specific forward guidance and said the market is “reasonably on message” regarding the outlook. That is, no rate cuts until 2025.

The central bank’s statement noted, “Taking account of recent data and the updated forecasts, the Board’s assessment is that policy is currently restrictive and working broadly as anticipated. But there are uncertainties. The central projection is for growth in household consumption to increase from the second half of this year as income growth picks up – and there is tentative evidence of an increase in spending in the September quarter. But there is a risk that any pick-up is slower than expected, resulting in continued subdued output growth and a sharper deterioration in the labour market.” Any slowdown in the labour market (which has been strong this year) would likely prompt the RBA into policy action quicker than before mid-next year.

On what it would take for the RBA to cut, Ms Bullock said, “It might be that consumption doesn’t perform. We expect consumption to pick up, but if that doesn’t eventuate, then demand isn’t going to be quite as strong.” I would also add that a jump in unemployment and a decline in new hiring would also count.

Latest News and Market Update

Businessearnings reportsFinanceglobal marketsinvesting insightstech stocks

Businessearnings reportsFinanceglobal marketsinvesting insightstech stocks

Oracle Surges +36% on Record Cloud Demand, Larry Ellison Tops Musk

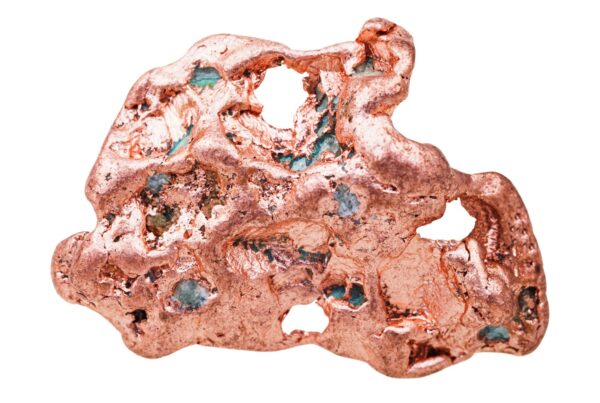

BusinesscommoditiesFinanceinvesting insightsmetals & mining

BusinesscommoditiesFinanceinvesting insightsmetals & mining