On Thursday, Wall Street benchmarks were little changed Thursday ahead of the key PCE inflation gauge due to drop tomorrow. Expectations that the Fed will move next week to cut rates continue to dominate the tape. Meanwhile November payrolls report scheduled after the Fed’s December meeting has markets leaning in on secondary indicators that paint a muddled picture of the job market. Bond yields rose while the dollar edged marginally higher. Gold and oil rose, while LME copper made a new record high.

Another major player in the financial markets joined the call for emerging markets exposure.

Fidelity International, one of the world’s largest global fund managers with more than $1 trillion in total assets, expects a similar outcome. Fidelity has joined in with several major Wall Street banks, including JP Morgan and Morgan Stanley, who believe the dollar’s decline will help drive further gains for emerging market equities in 2026.

Fidelity believes that a softer greenback represents a structural change that has only just begun to play out. Recent calls by Morgan Stanley, Bank of America Corp. and Goldman Sachs all forecast more weakness is coming for the US dollar, which is our base case as well. I sometimes get concerned when the consensus swings in one direction, but in the case of emerging markets, I believe the banks will call it correctly, given the still rampant under-positioning by most global investors. We could also see many of those same investors increase hedging activities against overallocation and exposure to US equities, which dominate global market cap.

Fidelity highlighted that Brazil is one market that could benefit, given the central bank rate is at 15%, while the economy has a solid growth outlook and inflation running at just 5%. “Holding Brazilian sovereign bonds at these real yields feels like a no-brainer. Much of the dollar’s move so far has been against the euro. By contrast, many of the major EM currencies are priced more for crisis than current realities, and we think there is more room here to run.”

This is a view also shared by veteran fund manager and emerging markets specialist Mark Mobius, who has been around for five decades. Mr Mobius remains constructive on emerging and frontier markets over the next few years. He argues emerging markets could be “the next big winners” next year, helped by faster growth in China and India and potential Fed easing. Similar to our view, Mobius believes that valuations remain at large discounts to the US while earnings growth in 2025–26 could outpace developed markets, especially in mid-caps.

89-year-old emerging markets veteran Mr Mark Mobius

In recent interviews and podcasts, Mr Mobius has highlighted China (despite its challenges) as currently outperforming the US, and continues to like Japan, India, Taiwan and Vietnam, citing corporate reforms, tech and manufacturing strength, and supply‑chain shifts. He has also pointed to Brazil and Argentina as beneficiaries of reforms and commodity exposure, and singled out defence, technology and gold as preferred areas over crypto for the next few years.

Shares in the Vanguard FTSE Emerging Markets, one of the largest exchange-traded funds listed in the US and UK that follows developing-world equities, have pushed up to historic resistance at the 20-year highs this year. This week’s advance came as Morgan Stanley reported foreign-fund inflows into Chinese equities held steady at $2.3 billion last month, but could accelerate as global investors address underweight positioning. As mentioned above, EMs continue to trade at a notable discount to global peers, with positioning still very conservative, leaving significant room for global allocations to increase.

I anticipate a topside breakout in the Vanguard FTSE Emerging Markets ETF (US: VWO) above 56 within the coming months – and for a new bull market in EMs to ensue. China/Hong Kong will likely be at the epicentre of this move, but many other markets could soon follow.

I also think Japan will have another solid year, with the ongoing bull market in equities driving the benchmarks further upwards into record territory. JPM, which is also bullish on Japan, noted this week that “risk-on sentiment returned in November on renewed expectations for Fed rate cuts, but BoJ Governor Ueda’s remarks on December 1 in the context of the weak yen were taken as suggesting a December rate hike and were generally factored in by the market.

JPY has recently started to strengthen, and the rise in long-term interest rates paused, and stocks bottomed out on December 2. Bank stocks were the best performers, while information & communication and electric power & gas were the worst performers.” We maintain an overweight position in Japanese banks across our Asia and global managed account portfolios

JP Morgan expects that Japanese interest rates and bond yields will continue a gradual rise, “rather than ascending quickly to the terminal policy rate”, and thinks the long-term outperformance of bank stocks will continue. I concur, and scope for further upside extension in the TOPIX bank index remains open next year. Despite the big rally and relative outperformance, the TOPIX bank index remains well below levels seen 25 years ago. The TOPIX bank index now has strong support at the 500 level, which represents the breakout from historical resistance and the exit point from a 26-year trading range.

I anticipate that the TOPIX bank index could rise towards 700/800 within the next two years, which would deliver another 40% to 60% upside on the solid returns that have accrued in the past five years. Even at 800, the index is still down over 50% from peak levels attained during the 1980s bubble, when the index rose above 1,500.

JP Morgan believes that next year the S&P 500 could hit 7,500 by December 2026 based on their view that the Fed will cut rates two more times. The bank holds a bull case target of 8,000 that could ensue if the Fed cuts rates further. In terms of the Japanese benchmarks, JPM expects the broader TOPIX index and Nikkei 225 to potentially rise to 3,750 and 55,500, which might prove conservative.

Finally, veteran economist and regarded Fed watcher Mohmmed El-Erian was interviewed this morning on CNBC and made some interesting comments. When asked whether the bond market was concerned about Kevin Hassett’s appointment as Fed Chair (given rising yields this week), he replied, “I don’t see Hassett’s possible appointment weighing on the bond market. While there has been a move higher in yields, this has more to do with Japan and higher JGB yields. I have no real concerns about Hassett assuming Fed Chair. He will inherit a fractured Fed, where the committee is divided…markets are way too focused on the short term, and not on the long term. All candidates believe the Fed needs reform, and I believe this as well.”

That was an interesting comment, and a shift away from the incumbent narrative that Mr Hassett (or one of the other five White House candidates) will undermine Fed independence. I would have asked the economist whether this was also weighing on the dollar.

Mr Mohammed El-Erian has called the Fed out for being backward-looking and has said that reform is badly needed.

Mr El-Erian went on, “While markets see Mr Hassett as doing the bidding of DJT, he only has one vote. It is a political appointment yes and that it is an issue. But the new Fed Chair will need to bring the committee along with him. It not that easy …they need to be more forward looking and have a unified vision of where the economy is going. Not backward looking like the incumbent Fed Board.” The Fed likely does need some reforms and over the past decade, with press conferences and the dot plot guidance around future rates, markets have placed much more weight on commentary that comes from key officials. I have no problem with this being dialled back and some reforms are made.

Mr El-Erian also holds this view and said that the “Fed needs reforms. They have made lots of mistakes. Fed independence is important but to maintain it, you need reforms … otherwise the outside world will do it. Whose the best of candidate of the five? – All 5 have said that reforms are needed. Kevin Hassett will do it…and I am not worried about the five candidates, but they have to impose reforms, stop the commentary and reduce the impact on markets. The Fed needs to move off centre stage, reform forward guidance and keep speaking to a minimum and be more forward looking…” Fair enough. Jerome Powell and incumbent officials have been way too data dependent, which, at the end of the day, is backward looking. As Warren Buffett said, investors need to be forward looking and not obsessed with the rearview mirror. This applies to the Fed as well.

When asked whether the Fed will cut rates next week…he said “Yes, the Fed will cut as the market expects, but likely deliver a ‘hawkish cut” and frame it up as data being confusing, not complete. This is the wrong approach. The Fed needs to look forward at where the data is going.”

This week, economic data boosted expectations of a rate cut at the upcoming FOMC meeting next week. An ADP employment report showed that private payrolls unexpectedly declined in November, pointing to a deterioration in the labour market and amplifying pressure on the Fed to ease. Official employment reports for October and November are due to be released, but only after next week’s decision.

Rate cut expectations lifted small/mid-caps, with the Russell 2000 index extending gains after last week’s +5.5% surge – the strongest weekly performance in more than a year. The “little bulls” are clearly running now for the small/mid-cap universe in the US market, which we have not seen in four years. This is encouraging for the rally scenario and risk-on environment into the year-end and early 2026.

The “little bulls” are now running, represented by the Russell 2000 small/mid-cap index. The recent breakout above near-term resistance sets the index up for a retest of the record highs in the coming weeks.

Earlier in the week, I noted that it is likely the Trump Administration will soon confirm a replacement for outgoing Fed Chair Jerome Powell (who, in my view, has done a good job). White House National Economic Council Director Kevin Hassett is being touted as DJT’s pick to next head up the Federal Reserve. As the President’s chief economic adviser, Mr Hassett is likely to be closely aligned with the incumbent government, but this will likely erode Fed independence next year, and be seen as such, but the financial markets.

Speaking on CBS’ Face the Nation on Sunday, Mr Hassett declined to address whether he considers himself the front-runner to replace Mr Powell; however, he cited positive market reaction to the news that Trump is seen as close to naming his pick. I don’t think the US bond market will remain agnostic to a Hassett appointment over the medium to longer term. In fact, the appointment will likely set the US bond market up for a big selloff, but not until later next year.

The Dollar Index has broken beneath the near-term uptrend. If the move lower in the US dollar is sustained, then the scope increases for a retest of the big historical support level at 96.5. All the major currencies had solid advances against the greenback, including the euro, yen, A$, and notably the pound, which had the largest upswing.

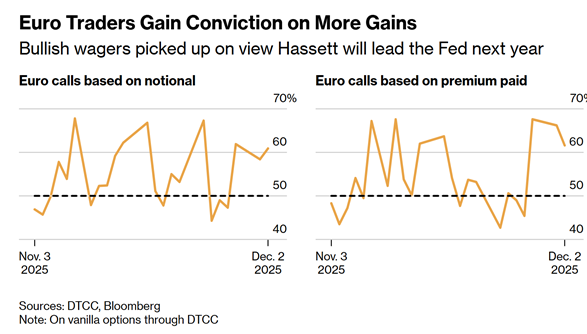

Dollar weakness is being driven not just by US rate cut expectations and anticipated changes to the composition of the Fed board. The euro is benefiting from softer energy prices, which have pushed Eurozone terms of trade to the best levels this year. Hedging is also playing a role as foreign owners of US assets move down the path of reducing portfolio FX risks. Hedging costs have fallen sharply for eurozone investors (and many other countries, including Australia), which is seeing an elevated supply of dollars on the global FX market.

Bullish wagers have picked up on the view that White House economic adviser Kevin Hassett will lead the Fed next year, and undermine independence.

Technically, the euro exited a multi-decade bear market earlier this year. The recent corrective selloff from near $1.19 now looks complete. The euro has found support below $1.14, and upward momentum appears to be now resuming. Seasonal patterns also point to the euro heading higher. December has traditionally been the euro’s best month of the year since its introduction 25 years ago. A peace deal with Russia/Ukraine could also bolster the currency. I see the euro moving higher over the coming months and soon retesting this year’s highs above $1.19.

Silver spot prices hit fresh record highs this week following a shakeout and corrective selloff in October and early November. Silver has been supported by not just rising expectations of a US rate cut in December, but significant new inflows into physically backed exchange-traded funds (ETFs) and ongoing supply tightness as inventories on the London and Shanghai Metal Exchanges tumble.

Silver’s new record highs come just over a month after a severe supply squeeze in the dominant trading hub London Metal Exchange (LME), last month. While the arrival of nearly 54 million troy ounces from Chinese vaults eased that squeeze, the market has remained tight with borrowing costs soaring. China’s inventories have also now fallen, which has added to market tightness.

The flows into the LME in London have put renewed pressure on other hubs, including China. Silver inventories at warehouses of the Shanghai Metals and Futures have hit the lowest levels since 2015. One analyst said that “in the short term, a further price increase cannot be ruled out if registered silver inventories in China continue to decline.”

The market is also sensitive to any potential tariffs on silver after it was added to the US Geological Survey list of critical minerals last month. While 75 million ounces have left the vaults of the Comex futures exchange in New York since early October, fears of a sudden premium for US silver have caused some traders to hesitate before shipping metal out of the country.

Silver has surged almost 90% this year, as investors have shunned crypto and turned towards precious metals, which are an age-old hedge against declining values of fiat currencies. I see this trend continuing for a number of years, with the recent selloff being nothing more than a corrective selloff in an ongoing bull market. Next year, should the bear market reassert in the global bond market (my base case), precious metals will really be the only viable alternative asset class for many central banks and investors.

In terms of silver, the outlook for both fundamental and technical frameworks remains highly constructive in my view. While optimism about the silver’s fundamental supply and demand balance has been bullish for prices, other factors could drive the market much higher next year, including consternation over holding fixed-income securities. And unlike gold, silver also has widespread industrial applications, such as being used to manufacture solar photovoltaics and many electronic components.

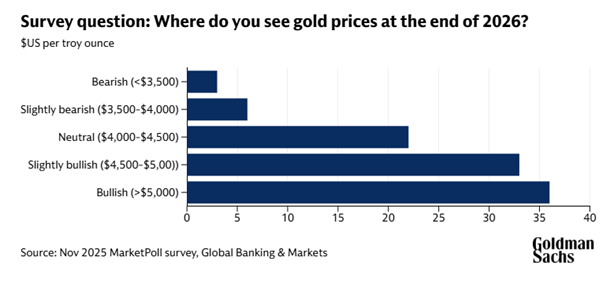

Goldman Sachs, in a weekend note to investors, said that institutional investors are becoming more bullish on gold stocks. The investment bank noted that “prices for gold has hit record highs this year, driven in part by surging central bank buying. Almost 70% of institutional investors expect gold prices to rise further by the end of 2026, according to a poll of more than 900 clients on Goldman Sachs’ Marquee platform conducted from November 12-14.The largest proportion of respondents – 36% – think gold will exceed $5,000oz by the end of next year (gold traded at $4,158 on November 27).” Normally, this survey would make me highly nervous. However, notwithstanding what is happening at a high level in terms of global macroeconomic conditions, gold rising above $5000 makes sense given that there are few alternative ways to hedge.

Goldman noted that “central bank buying of gold and fiscal concerns were seen as the main drivers for the precious metal’s prices in 2026 by 38% and 27% of respondents”. There is trouble brewing in global bond markets, and I see this playing out in late next year when it becomes apparent that governments, and most notably the US, are going to have to increase issuance to finance deficits. Capital is flowing into gold and precious metals as a hedge and as a way to protect against capital likely coming losses in fixed income markets. As a point aside, equities are also going to be seen as a hedge and provide better protection against inflation, and I remain constructive over the next six months, where returns could surprise on the upside.

Have a great weekend!

Carpe Diem!

Angus

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.