Gold: spot prices are approaching $4000oz with some warning of a major top. Gold has been among the top performing assets classes this year, as have silver and platinum. Returning to Ed Yardeni, he wrote on Monday that gold’s record breaking rally could last through the rest of this decade, and “ultimately pushing the precious metal to $10,000oz”. I concur with Ed Yardeni that the bull market cycle in precious metals has much further to run in terms of where the US dollar is likely headed. This points to the bull cycle in PGMs have much more to run in terms of time.

Mr Yardeni’s price target implies the price of gold rising 151% over the next five years – which he believes will outperform the S&P500 where he holds a 10,000 price target underpinning a +50% increase. We saw a similar dynamic playout in the last commodity bull market when gold ran higher from $250 in 2000 to a peak above $1800 over close to 12 years.

Underpinning Yardeni’s bullish gold forecast are several factors. Economic and geopolitical forces have shaken up the status quo in recent years, “causing investors to flock to safe-haven assets like gold.” This includes the narrative around DJT’s tariffs, attempts to undermine Fed independence and lower interest rates, and China’s housing woes pushing Chinese consumers into gold.

He is also an advocate of central bank buying continuing “Our bullishness is supported by the ‘Gold Put,’ provided by central banks that are increasing the percentage of their international reserves in gold. “Gold looks on track to shatter the $10,000 mark if it keeps up its current pace. So far, so good. Gold already looked to be within “shouting distance” of our year-end price target of $4,000 an ounce for 2025.”

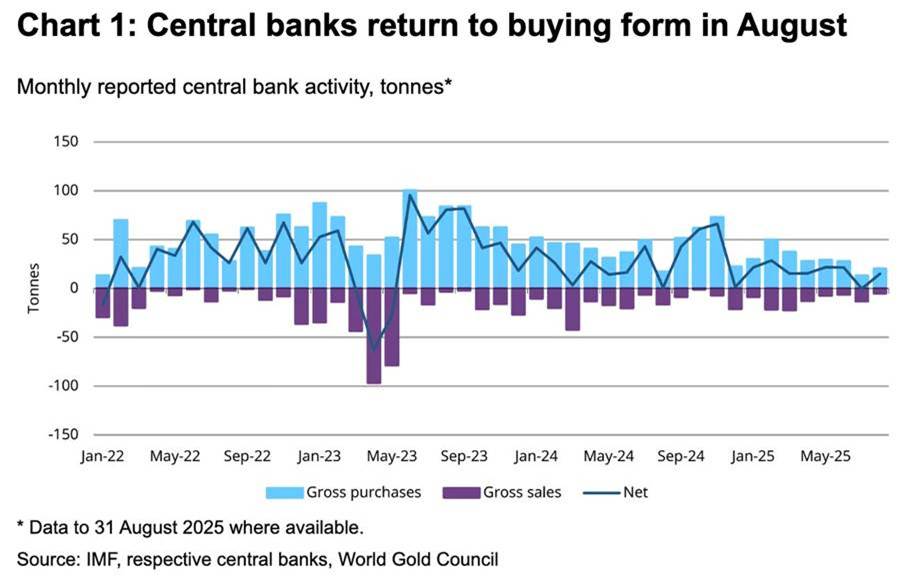

I agree with all Ed Yardeni’s points and have often expounded the same narrative. I would also add that a bear market underway in the US dollar – which has yet only really begun – could have much further to go where gold will be seen as the ultimate hedge. Central banks have been aggressive gold buyers in recent years, one of the factors supporting bullion’s latest leg up. And according to the latest update from the World Gold Council, central banks around the world added a net 15 metric tons of gold to their reserves in August. Kazakhstan, Bulgaria, and El Salvador ranked as the largest buyers that month. The key point here is that most developed economies are not buying gold yet – but this could change next year – particularly if the US dollar and the global bond market comes under renewed pressure.

Individual and institutional investors have also shown high interest in gold as a safe haven this year, but I would expect these flows to also accelerate given still low global positioning.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.