Chinese equities surged on Monday, extending a liquidity-driven rally that some believe is showing signs of euphoria in certain pockets of the market. I believe that key China/Hong Kong benchmarks are resuming a bull market, which is only in the very early stage of an innings. The path of least resistance is to the topside, given valuations are still cheap, with prospects for the domestic economy improving.

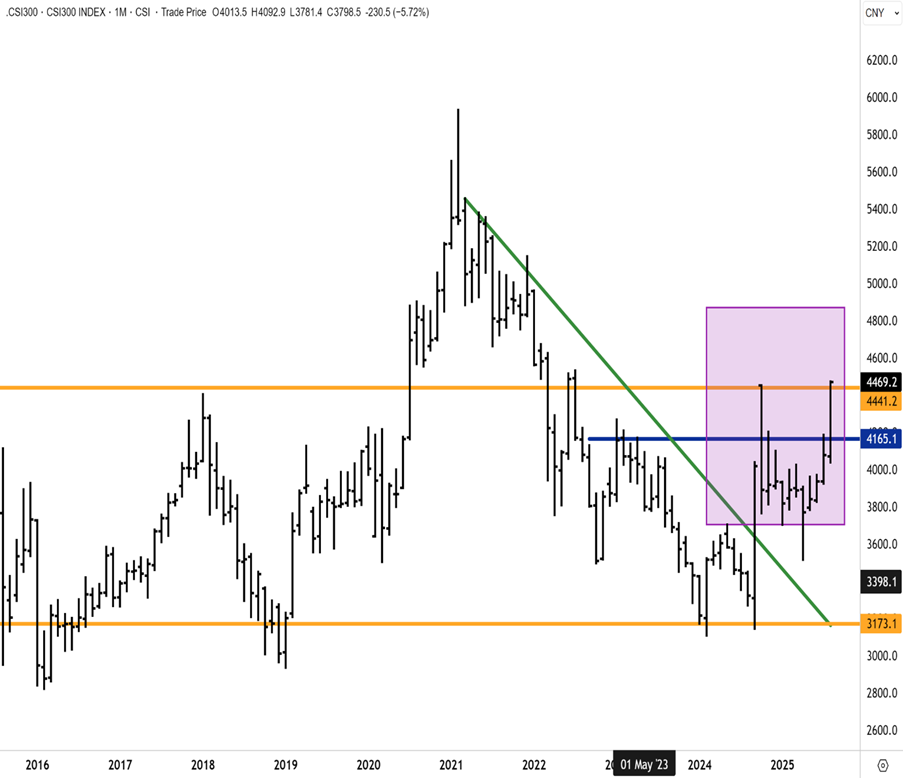

Coming off its best week since November, the benchmark CSI 300 index surged +2.1% yesterday with turnover on both the Shanghai and Shenzhen exchanges reaching a combined 3.1 trillion yuan ($433 billion) — the second highest on record. Chinese investors are deploying some of the record US$18 trillion in savings into stocks as property is still avoided, and interest rates are held low by the central bank. The CSI 300 Index reached a three-year high, and the Shanghai Composite Index hit levels not seen in a decade. The CSI300 is close to confirming a breakout above key resistance at the October ’24 highs. Once confirmed, we anticipate a resumption of upward momentum in the CSI300. The 4800 level is a plausible price target for the index before year-end.

Mega-cap Chinese tech companies (which we hold as overweight positions across our portfolios and in the Fat Prophets Global Contrarian Fund) led the rally. However, yesterday property stocks also rallied (see last week’s notes) on expectations that the government will soon ramp up support measures. Many Chinese developers’ shares rallied on Monday, including Longfor and China Vanke, which hit a six-month high. The rally does not surprise me, given that liquidity is abundant – and the flow of consumer savings into the stock market has much further to run.

The Hang Seng Tech index (comprised of major Chinese large-cap tech companies) has broken through near-term resistance following a successful consolidation above key support at 5000 in recent months. We have conviction that upward momentum is resuming with the next price target for the index residing just below 7000. Our base case is that the HS Tech index will test this level within six months.

The latest good news came from the property front. Shanghai eased home-buying rules to arrest the prolonged decline in property prices. The policy changes allow eligible residents to buy an unlimited number of homes in the outer suburbs. That lifted many developers, such as China Vanke, by as much as 10%.

Property developer Longfor, which I flagged last week (see Last man standing), came close to breaking out above significant overhead resistance. I remain confident that Longfor will soon exit a long-established trading range and resume upward momentum.

The gains in the property sector likely reflected growing expectations of further policy support from the Government, which I think is coming down the line soon. Meanwhile, the policies announced by Shanghai to bolster housing demand (and including easing buying restrictions in the suburbs) are a step in the right direction. Additional measures could come as early as September, with authorities preparing to speed up urban renovation projects, which will provide further support for the property sector.

On the three-year weekly chart below, Longfor looks to be on the cusp of an important technical inflection.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1095.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.