Running the course

First up, a couple of weeks ago, I mentioned that I would not be surprised if Warren Buffett’s Berkshire Hathaway showed up on the James Hardie share register, given the sharp decline in share price this year despite the underlying quality of the business. Mr Buffett recently made headlines for substantially increasing Berkshire’s shareholding in Lennar, one of the largest homebuilders in the US. In the second and third quarters of 2025, Berkshire raised its stake to over 7 million shares, worth approximately $889–$910 million – a major jump from prior levels and representing a 265% increase. This holding is now a notable position within Berkshire’s portfolio.

The rationale behind the investment points to an underlying confidence (and opportunity) in the US homebuilding sector, which we also identify with. The country is facing a housing shortage of nearly 4 million homes, and the only solution is for building activity to accelerate. Berkshire’s move indicates optimism that the US housing market will soon rebound and support new home sales and affordable inventory to American homebuyers. If the Fed follows through next year on rate cuts, then housing will receive another boost.

Mr Buffett’s investment team appears to view Lennar as a classic “Buffett pick”, a business with a strong competitive position, a significant share of the domestic home-building market, robust financials, and a history of delivering shareholder value through buybacks and dividends. I would place James Hardie into this category, although I concede that with a market cap of around US$10 billion, the company might be a bit small. Lennar and D.R. Horton have market caps of $30bn and $40bn and are much larger.

Lennar has fallen sharply by around +30% since the 2024 highs above $183 to recently trade at $116. The stock appears to be finding support now at the primary uptrend (in place since the 2020 pandemic lows), and I have confidence that the corrective selloff from the ‘24 highs is close to completion.

Source: Goldman Sachs

I agree with this outlook, and all that is likely needed now is for the September/October labour market reports to confirm further job losses, and the stage will be set for a rate cut in December. With the upward inflection in the stock market on Monday, accompanied by signs the Fed is leaning towards another rate cut, our base case for a “risk on” rally into the year-end remains intact. Additionally, the improvement in commodity markets across the full spectrum is also encouraging and points to a strong US and global economy next year.

Goldman is also bullish on the outlook for China. The investment bank noted on the weekend that “one of the biggest concerns for investors around the world has been trade tensions between the US and China. But despite the tariffs, China’s exports have been resilient. “Between the structural trends in Chinese manufacturing, competitiveness in these high-tech sectors, and rerouting and supply chain responses, we’re seeing a super resilient Chinese export picture this year”.

Goldman noted that “at last month’s Fourth Plenum, Chinese policymakers laid out a five-year growth plan that commits to building a modern industrial system and further advancing manufacturing competitiveness. And last week’s Trump-Xi meeting may further support China’s export growth, as both countries agreed to pause certain tariffs and export controls.” The deal on tariffs was a circuit breaker for China’s economy in my view, and buys a lot more time for the government to shore up alternative export channels with other countries.

Consequently, Goldman Sachs raised their China GDP growth forecasts to 4.8% for 2026 and 4.7% for 2027 (up from 4.3% and 4%, respectively). These forecasts are significantly above market consensus. I am not surprised that China’s CSI300, Shanghai Composite and Hang Seng Indexes have reasserted upward momentum in the past week. The bull market, which has seen all benchmarks outperform global equities this year, could well continue into next year. The strong growth outlook held by Goldman (an outlier) is likely being priced into Chinese equities ahead of what could be a resurgence in the economy and consumer spending next year.

The +6% correction in the Hang Seng index, which has undergone a six-week consolidation since early October, now appears to be over. The breakout above the near-term downtrend around 26,000 likely concludes the technical correction and marks the resumption of upward momentum. I am anticipating a retest of the record highs by year-end.

The correction in gold and other PGMs that has been playing out since October, when conditions became quite overbought and frothy, might have also concluded. The “chequered flag” on the correction could well be flying, given the upward dynamics in silver, platinum and gold point to resuming upward momentum. China’s central bank, the PBOC, has been on a buying streak. The PBOC added to its gold holdings for an 11th straight month in September, and with the gold correction stalling below $4,000oz, chances are the PBOC and other central banks have resumed buying in recent weeks. The PBOC is also aiming to become a custodian of foreign sovereign gold reserves to rival London’s LBMA.

I continue to see the current housing market headwinds in the US quickly dissipating next year and giving way to a surge in activity and a sharp sector-wide rebound. High mortgage rates and affordability concerns have hampered the industry, but this could quickly change if the Fed lowers aggressively next year (our base case) and possibly even intervenes in the mortgage market to lower rates.

Considerable pent-up demand, along with a 4 million inventory shortage, could see demand explode higher in 2026. The recent step by Berkshire into US house builders is totally consistent with Buffett’s philosophy of acquiring quality businesses during cyclical downturns, positioning for both sector recovery and higher shareholder returns. I see James Hardie (and Zillow) as both ticking the box on this front.

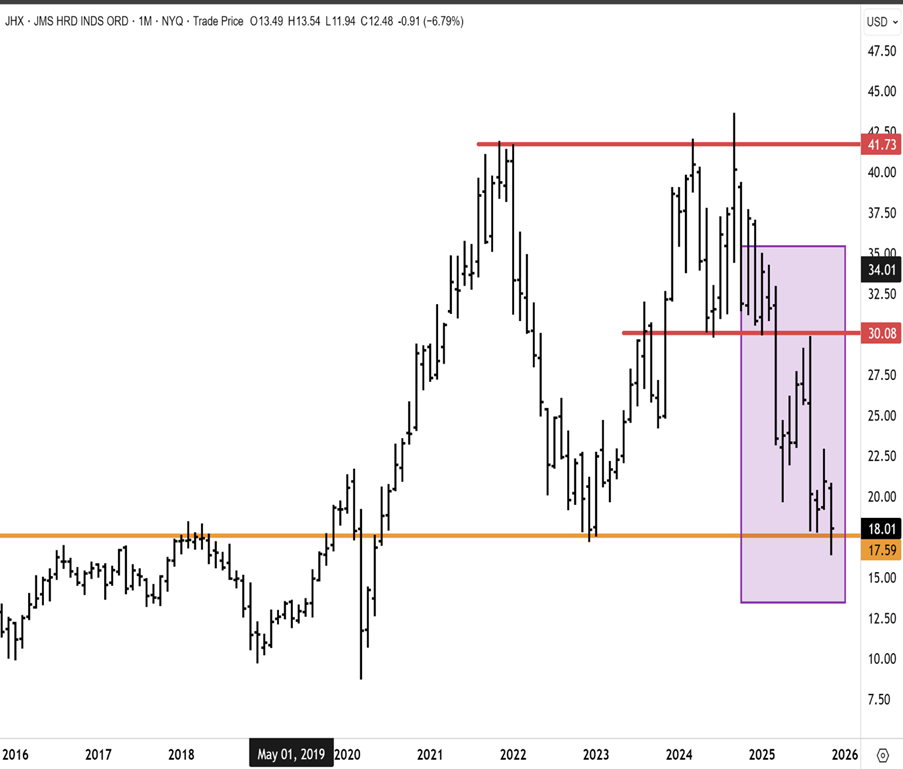

James Hardie also looks to be approaching a bearish extreme. The stock this year has declined over 50% from the record highs and is now back at the big historical support level near $18. We have conviction that this key support will hold. James Hardie reported better-than-expected earnings to the market yesterday and confirmed the recently acquired Azek business was performing ahead of expectations.

Morgan Stanley came out with a bullish stance on Japanese equities, with a headline “Rising Sun, Roaring Bull”. I have long been bullish on Japanese stocks, and despite the volatility this week (which is a healthy correction to the record highs), I see opportunity in a bull market that could run for years.

Morgan Stanley also believes the bull market remains intact and noted this week that “Japan’s economy is transitioning from a low-inflation environment where expected inflation was clearly below 2% to a phase in which, as the output gap gradually closes, inflation converges toward the 2% target. This shift is opening the path to a future of sustained growth, wage increases, more flexible pricing, active investment, and productivity gains.” I would also add that return on equity is rising in Japan, and this is being reflected in higher returns to shareholders.

Corporate reforms by the Tokyo Stock Exchange and the government are also playing a role. MS noted that “with the anchoring of sustained, stable inflation, both corporates and households are being nudged to revisit how they manage their balance sheets. Corporate governance reforms led by the Tokyo Stock Exchange and the Financial Services Agency, together with the expansion of the Nippon Individual Savings Account (NISA), are strongly reinforcing these moves.”

Japanese savers are now being encouraged by superannuation reforms to invest in Japanese stocks, which reverses the trend since the early 1990s of sending capital overseas.

Valuation in Japan is also still cheap. MS noted that “our base case remains constructive, and we forecast TOPIX reaching 3,600 in December 2026 (+7% versus 12 November 2025). Accordingly, we maintain our positive stance on Japanese equities while emphasising the importance of building portfolios that can withstand unexpected shocks and adopting dynamic rebalancing strategies”.

Since breaking out above 2,900 back in August, Japan’s TOPIX has made a new record high at 3,400. The index has since corrected half of this move, which is about 250 points. I am confident the TOPIX will soon find support around 3150/3190 and reassert topside momentum into year-end and possibly the historic highs.

MS noted this week in an outlook on Japan that “the current interim results season stands out for a higher-than-usual frequency of guidance upgrades and stronger-than-usual positive share-price reactions, highlighting robust momentum. Beyond resilient earnings forecasts, continued improvement in capital efficiency and corporate governance reforms should enhance corporate earning power and help lift medium-to long-term ROE”. The earnings season has been very strong in Japan, and with the recent corrective selloff, another buying opportunity is emerging in Japanese equities in my view. We hold a number of Japanese stocks across our portfolios and notably an overweight position in Japanese banks and financials.

Finally, turning to Australia, the RBA board minutes effectively signalled that rate cuts are now a high bar event, only likely if the labour market or household spending deteriorates materially. In both cases, the RBA expects that weaker demand would ease inflationary pressures and justify lower rates. It should be noted that neither scenario matches the Bank’s central forecasts, which have unemployment steady at about 4.4% for two years and real GDP growing at roughly 2% per annum.

For rates and bond markets, the minutes are mildly hawkish. Underlying inflation forecasts have been revised higher since the August Statement. The central bank expects inflation to fall to about 2.6% by the end of 2027, slightly above the midpoint of its 2–3% band, on the assumption that there are a further 30 basis points of cuts still to come. The minutes, however, revealed that if the cash rate were simply held at 3.6% for the forecast horizon, inflation would settle closer to 2.5%. That asymmetry wasn’t further explained, but by the Bank’s own numbers, doing nothing on rates delivers a better inflation outcome than easing further. Interesting. Anyway, the minutes noted that “staff viewed the risks around the inflation outlook as balanced.”

This was yet another commentary that sets the scene for the RBA to be data dependent. However, I see further deterioration ahead for Australia’s labour market, which has been surprisingly resilient, but the trend has been for companies to shed staff this year, and this might continue. Any further lift in the unemployment rate would undoubtedly force the RBA’s hand and be the likely catalyst for another cut.

Crypt “oh”

The US dollar is experiencing a rebound which might continue for a while yet, but I have conviction that another big leg is in the offing. The dollar bear market is not done yet, and we likely have only seen the first innings. One FX trader that I follow closely had this to say about the greenback. “In a market starved of official data, even a distorted signal becomes scripture. We’ve built an entire three-month macro narrative around shadows; tomorrow, we get a single candle and pretend it’s daylight…Here’s the trader lens: the asymmetry is brutal—weak hits harder than strong helps. A stronger [labour market] print offers only limited reassurance, because it’s stale and contradicted by October’s layoff surge. A weak print, on the other hand, fuels the deepest fear across macro desks—that Powell stayed hawkish into a slowdown he couldn’t see. That’s when the “behind-the-curve” whispers start to distort price action.”

This is a great summary of where the greenback is at. For the rebound rally to continue, global FX markets need to believe the Fed won’t cut rates next year and narrow rate differentials and that the US economy will continue to grow and outpace the rest of the world and that US assets will continue to deliver superior returns into infinitum. I have a very different view.

Our FX trader colleague also holds a similar disposition. Yesterday he wrote “A firm [employment jobs] number above 80k keeps USD supported, pushes USDJPY into uncomfortable airspace where Tokyo starts speaking louder, and pressures AUD and Emerging Markets. Dollar longs press but don’t celebrate — the data is too old to validate anything. A soft print below 30k or a rise in unemployment, however, could flip the board. Yen shorts get smoked and fresh dollar longs blink hard—because not only does the heart of the economy look broken, but because the Fed suddenly looks unsure of its footing.” Well said!

The rally in the dollar/yen looks close to exhaustion following the breakout from the downtrend that has been in place since mid-2024. Resistance looks to be formidable around the Y158 level, which I believe will be a turning point for renewed yen strength (as the BOJ is forced to hike) … and likely resuming dollar weakness.

My FX colleague succinctly summarised the situation in FX markets as follows…“The data gap has forced traders back into intuition and reflex, and in that kind of fog, the dollar becomes the market’s shock absorber. A weak print can trigger a brief but violent “policy mistake” tantrum—rates lower, dollar lower, yen ripping higher. A strong print keeps the Fed sidelined longer, pushes the front end higher, and tests USDJPY at altitudes where actual MOF intervention could become an option; however, I don’t think Tokyo will waste ammunition on a hawkish Fed print.” Again, well said and some great points.

I believe turmoil is approaching in FX markets where loaded US dollar longs are going to be badly shaken and disappointed. The selloff in the yen against the dollar looks increasingly unstable and unhinged. A wall of resistance is about to be tested at the Y158 level. I believe a powerful rally in the yen is around the corner and a selloff in the US dollar is coming, and possibly ignited by a coming rate hike from the Bank of Japan.

As my friend accurately summarised, “But the real story isn’t tomorrow’s jobs number. It’s the market trying to decide whether the Fed is guiding the landing—or drifting deeper into the clouds. In this visibility, the dollar stops acting like a currency and starts behaving like a heartbeat monitor. And tomorrow at 8:30 ET, we get to see whether the rhythm steadies—or slips.” That was brilliant!

And in gold we trust.

Off the menu…but for the records.

The chart below is of gold priced in Japanese yen. Since 2006, the price in yen has surged from ¥40,000 to a recent new record high above ¥650,000. That is an increase of sixteen times. Over the same period, gold in US$ terms has increased just 8 times. There is a gap that has opened up …and it is not about the gold price but about fiat currencies, their intrinsic worth, how public trust has been continuously eroded and perhaps most pertinently – where they are headed.

What will the US dollar and other fiat currencies, including the pound, A$, euro and yen, buy tomorrow?

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.