US stocks surged on Thursday as upward momentum resumed following a better than expected CPI report, which confirmed inflation increased less than expected. All the major benchmarks rallied, led by the tech-laden Nasdaq. Investors were encouraged by the CPI print, which underpins the case for more rate cuts from the Fed. Meanwhile, chipmaker Micron reported a blowout earnings result and raised guidance, which saw the Nasdaq rebound sharply off the 100-day moving average discussed yesterday. Bonds rallied, the dollar held steady, and most of the PGMs extended higher.

The S&P 500 rose 0.79% to 6,774, while the Dow Jones lifted 0.14%. The Nasdaq Composite led the rally as investors bought the dip in technology stocks, gaining 1.38%. The Russell 2000 advanced 0.62%. Futures markets are pointing to a decent ‘follow-on rally’ today in Asia and Europe.

The Australian market meandered in a narrow range on Thursday, with the ASX200 finishing flat on the day with +0.03% gain to 8,588. There was some dispersion below the surface, with a tilt back towards defensives, as consumer staples led. Despite a positive lead from American peers, the local energy sector fell sharply, with the major domestic energy stocks continuing to screen cheaply. Breadth was weak, with advancers barely edging out decliners in the broader market. The Aussie dollar rose to US66c, while SPI futures are pointing to gains of 0.6% on the open. A$ spot gold eased back to $6,435oz.

I have been fervently bullish on copper this year – and some of the world’s largest copper producers, including BHP, Rio, Antofagasta, Capstone Copper and the Global X Copper miners ETF (US:COPX, AU:WIRE). Aside from BHP, all these names have made new record highs. Copper supply constraints have led to soaring prices and significant inventory stockpiling in 2025.

According to BHP CEO Mike Henry, the world’s largest copper miner, prices are not coming down anytime soon. In an interview on CNBC, he outlined a bullish forecast for the red metal, which traded at a record high of $11,952/ton on the London Metal Exchange last Friday.

BHP is the world’s biggest copper producer, and I have a high conviction view that the stock will trade much higher over the coming years, and possibly well north of A$60. Rio Tinto has already broken out above $140 to new record highs – and it is likely only a matter of time before BHP follows suit. The BHP CEO noted that over the course of the past year, the market had gone from a slight oversupply to bottlenecks, pointing out that 12 to 18 months ago, analysts were expecting 2025 to be “a little bit soft” for the red metal. Similar to expectations around weaker iron ore prices, this view has proven to be wide of the mark.

This year, investors have become increasingly fixated on AI, with the mega-cap tech giants delivering outsized gains in the US stock market. However, rotation is now occurring below the surface as investors embark on a large-scale shift and diversify into sectors that have not delivered much over the past four years. This is becoming evident with the relative outperformance of the Russell 2000 in recent months.

Earnings are set to run sharply higher for most US companies next year as interest rates are cut and the Fed accepts higher inflationary risks and runs the economy hotter than in previous cycles. I continue to have conviction that the US and global equities are on the cusp of another move to the topside, with the bull market continuing into next year.

Goldman Sachs weighed into the debate about where markets are headed and highlighted that the bigger opportunities next year may come from somewhere else. The banks’ strategists noted in a report on Thursday that “at the sector level, we expect the 2026 acceleration in economic growth will boost EPS growth most in cyclical sectors including Industrials, Materials, and Consumer Discretionary.” Goldman also believes the White House will continue to alleviate tariff pressures on the economy (as inflation potentially rises) and dial back some of the more severe trade measures in a more focused approach.

Goldman noted that “despite the cyclical rebound and widespread economic optimism in our client conversations, the market does not appear to be fully pricing the likely economic acceleration in 2026. “The overall US growth could pick up next year, and drive a 12% rise in S&P 500 earnings per share.” The bank makes a fair point, and with the Russell 2000 only recently breaking out and sustaining above the 2021 highs, I would expect the bull market to continue advancing well into next year.

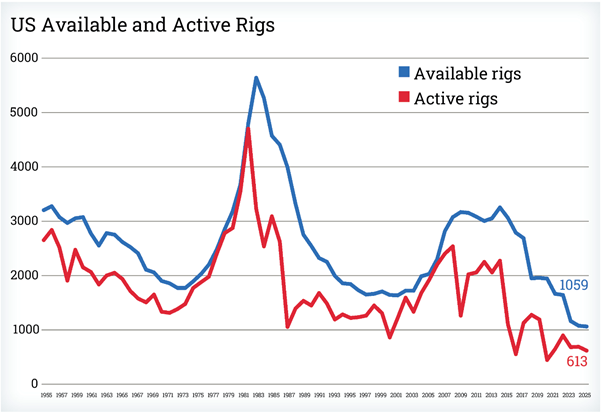

According to Trafigura (which is one of the world’s largest commodities trading companies), the long-predicted “super glut” of oil is expected to hit energy markets in 2026. The firm believes the oil market will see a flood of new supply at a time when global demand is levelling out. The chief economist at Trafigura said on a recent earnings call, “If we look at what is driving the expectations of that super glut, it’s hard to see how we don’t get there”.

However, the US, which is the world’s largest producer, is struggling to remain economically viable in the low-price environment. At some point, higher cost marginal producers in the US and globally will shut down production and halt all exploration.

WTI crude oil has this week broken down below key support at $57 to mark a new four-year low at $56.50. Oil prices are resuming downward momentum and could now fall towards the low $50s. However, at this level, the pain threshold for most high-cost producers becomes acute.

Yet despite what appears to be an overwhelming bear case for oil prices in 2026, the SPDR Energy ETF – US: XLE – (which is the largest exchange-traded fund of all the major US energy companies, including Exxon Mobil and Chevron) continues to hold up and is within a short distance from the record highs. This is perplexing given the ETF traded down to extreme levels during previous oil market downturns, including 2002, 2008 and during the pandemic (when oil prices briefly went negative).

UK-listed energy companies exhibit a similar pattern to XLE, as does the French-listed energy monolith, Total Energies.

Something else is going on in the energy sector that is not immediately obvious to Main Street. Oil prices might just be nearing a major bearish extreme and important inflection point, which contrasts with consensus expectations of analysts. Bear markets always bottom out on maximum pessimism.

On the strategy side Down Under, Macquarie’s equity strategists are heading into the new year with a renewed appetite for miners (which we have been bullish on for some time), arguing that the prospect of higher interest rates marks a shift to a late-cycle phase where resources typically do well.

Macquarie believes financial markets are moving toward the later stages of the economic cycle, a backdrop that has historically been supportive for the ASX’s heavyweight materials sector even as borrowing costs rise. Money markets are now pricing roughly a one-in-four chance of a rate hike in Australia as early as February, which the strategists describe as the highest such probability attached to any major central bank globally.

In Macquarie’s model portfolio, the mining sector is its top overweight, and it has topped up exposure to BHP while adding uranium producer Paladin Energy and copper miner Capstone Copper. While we don’t see early 2026 RBA rate hikes as a given, we remain bullish on the broader metals complex due to the scope for improved demand profiles against constrained supply dynamics after a long period of underinvestment. China is forging ahead with new projects like the Tibetan mega-dam, the AI rollout is a new demand driver, and when a Ukraine/Russia peace deal is inked, hopefully, the people of Ukraine can soon move forward with rebuilding destroyed infrastructure.

The mid-year Economic and Fiscal Outlook (MYEFO) for 2025/26 (think interim budget) landed without much market drama, largely because the government didn’t spring any big fiscal surprises and the broad settings still point to steady, growth-friendly policy rather than abrupt tightening.

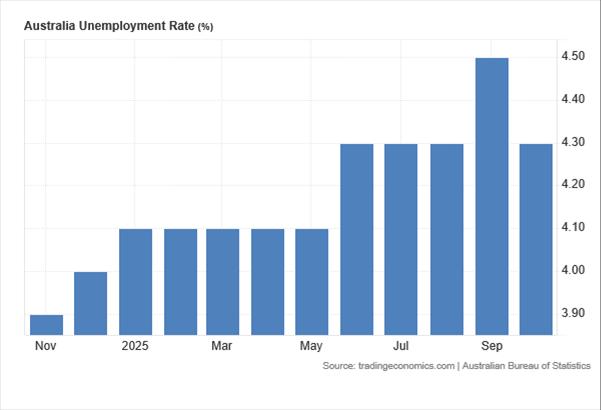

On the real economy, the update pencilled in unemployment edging up to 4.5% by mid-2026 alongside a higher participation rate, with wage growth steady at 3.25% and household spending growth expected to be a touch firmer than previously forecast. New measures add to the near-term spending profile, including $9.1bn in extra payments this year and $31bn over four years, spanning mental health, aged care, community infrastructure and support for industries such as steel and copper.

Source: MYEFO

With inflation still the swing factor, steady fiscal policy also increases the likelihood that the heavy lifting on containing inflationary pressures stays with the Reserve Bank of Australia.

Meanwhile, in Japan, BOJ data released Wednesday showed household financial assets climbed to a record 2,286 trillion yen (US$22.2 trillion) at the end of September, up +4.9% year-over-year, driven by higher stock prices. The composition revealed a historic shift in Japanese savings behaviour. Cash and deposits fell below 50% of total assets for the first time in 18 years, dropping to 49.1% as households moved 317 trillion yen into equities (up +19.3%) and 153 trillion yen into investment trusts (up +21.1%). The migration from savings to investments reflects the impact of the NISA tax exemption program for retail investors. We have talked about how this should be a supportive factor for Japanese equities, and with more money set to be repatriated, big changes are afoot.

We remain bullish on Japanese stocks into 2026.

This week, we reviewed our Baker’s Dozen predictions for 2025, touching on a few each day. For those who missed it, we will also be publishing these next week as a full group – keep an eye out for that. While we didn’t hit the mark on all of them, we did score some bullseyes this year.

Here are two of the calls we made back in December 2024, looking ahead to 2025.

at No.#10. In December last year, we made the following call: –

- “Australia has a closely run election – PM Anthony Albanese faces a huge battle at the polls to retain power. As in America, the lower socio-economic factions are increasingly frustrated over not being able to keep up with the rising cost of living and express this at the polls. The job market frays and unemployment rises. The high cost of living becomes a central issue for many voters, along with the debate around nuclear energy versus renewables, given rising power costs.

“The ASX200 powers ahead after a corrective selloff but receives a big boost from China’s stimulus, which drives a big recovery in commodity prices and the resources sector. The index touches 9,000 during the year as the bull market defies an economy on the edge of recession and looks through to higher commodity prices as the year rolls on. The lucky country continues to be lucky.”

Half of this prediction was clearly wide of the mark and wrong. The Labor Party ended up winning the election convincingly in a landslide, with 94 seats (out of 150), producing a strong majority government. The Coalition received the lowest polling in history. The unemployment rate ticked upwards, but hasn’t deteriorated markedly based on the headline numbers.

However, our call on the Australian stock market proved to be quite prescient. The ASX200 endured a correction linked to the Liberation Day tariffs, though it quickly rebounded and notched closing levels above 9,000 in late October (supported by a strong performance from resource stocks). At the time of publication last year in December, none of the major investment banks and brokers foresaw the ASX200 rising above 9,000, and were clustered around the 8,500 level. The key benchmark did in fact rise to 9,115 during the year.

Although the ASX200 has corrected into year-end, we are bullish in our outlook for next year and see the benchmark rising well above 9,000 in 2026, driven by resources and banks, and a resurgence in domestic technology stocks. Half a mark was attributed to this prediction.

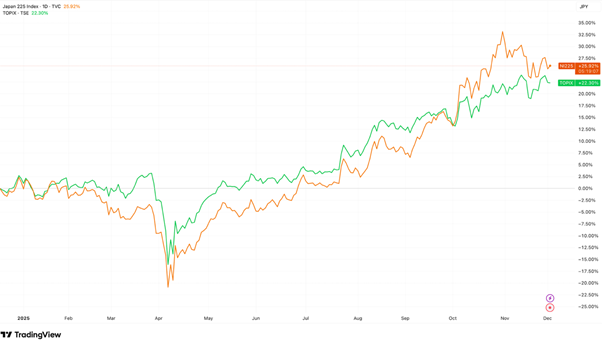

Moving on to our final call, No.#13, which rounded out the Baker’s Dozen of 2025, it was as follows:

“Japan also powers ahead in 2025 with the economy benefiting from resurgent demand from China, a robust domestic economy, and sustainable inflation rates. The Bank of Japan raises the base rate to at least 1%, the highest level in 30 years.”

“The Japanese stock market has another solid year of returns, with the TOPIX and Nikkei making new record highs above 44,000 and 3,300, respectively. The yen appreciates against the US dollar as the ECB and Bank of England cut rates. After being the worst performer in recent years, the yen leads the rally amongst the major currencies.”

We got elements of this prediction clearly wrong, but the key call of Japanese equities rising totally hit the mark. In fact, Japanese equities were the best performers this year and beat Europe, the US and all the other developed country stock markets. The Nikkei notched up gains of c+25%, and the broader Topix index rose +22%, delivering some of the best returns in decades.

The Bank of Japan did raise rates and by 25bps back at the January meeting, which took the cash rate up to 0.5% – but we were wide of the mark in our call for more tightening to 1%. After the initial hike, the BOJ remained on pause. The BOJ governor has signalled another hike is likely, and potentially today after the meeting, which would lift the cash rate to 0.75%.

Further missing on our No 13th call was the over estimation of strength in the yen. The yen has been choppy this year against the dollar and opened at Y157 and has only modestly appreciated against the greenback, and certainly lagged the euro and pound. We received ¾ of a mark for this call.

Overall, it has been a phenomenal year, and one of our best in 25 years, with an overall score of 11 out of 13 for this year’s predictions coming through.

The Tribe has Spoken

We conducted our annual member survey this year and received an “A” for our work on the daily FatChat this year, with similar “A’s” for the Australasian, Mining and Global Equities reports. Thank you to all those members who responded. We appreciate your support.

Finally, the Fat Prophets Global Contrarian Fund has had a return to form in 2025. This morning, the Fund updated the ASX and estimated pre-tax NTA rose above $1.91 – the highest level this year. The company also paid a special fully franked dividend of 5 cents earlier this year.

The Fund has had a solid performance primarily driven by a focused strategy of anchoring the investment portfolio to three core themes. Precious metals holdings did well, including miners involved in gold, silver, platinum, palladium and copper. Japanese banks also did well with the TOPIX rising to the highest level in 25 years. Core Chinese technology holdings performed, but not quite as well.

FPC shares have risen close to c40% to an all-time record high this year and still represent an attractive opportunity for those investors seeking value (the stock still trades at a c25% discount to estimated $1.91 pre-tax NTA) and exposure to core Fat Prophets themes.

Fat Prophets Global Contrarian Fund share price in 2025

Be sure to catch our Baker’s Dozen predictions for 2026, which will be published early next week, and mark my final note to Members for the year. My daily note resumes after the Christmas/New Year break on Thursday, 8th January.

Enjoy your weekend and carpe diem!

Angus

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.