On track to hit the top end of 2021 guidance

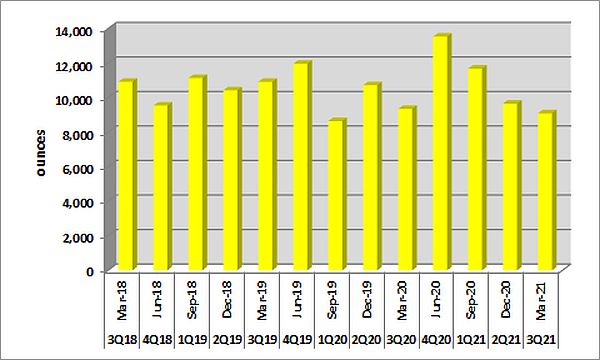

Sandfire Resources has released its third quarter operational results, reporting a fall in its headline production numbers for the quarter and a rise in costs. Production guidance for 2021 was maintained, with Sandfire’s expectation of reporting toward the top-end of the range and it did provide an upgrade on cost guidance numbers for 2021. A snapshot of the balance sheet revealed no debt and a swag of cash. The following table is a summary of Sandfire’s March quarter operational results:

Source: Sandfire Resources

Overall, the March quarter result was, in our view and at best, a satisfactory one, with our view espoused on the positive changes to 2021 guidance numbers. Meanwhile Sandfire’s very strong balance sheet remains a key attraction.

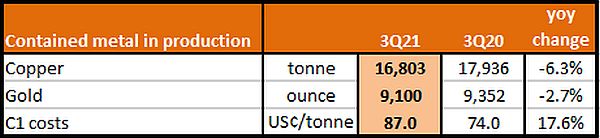

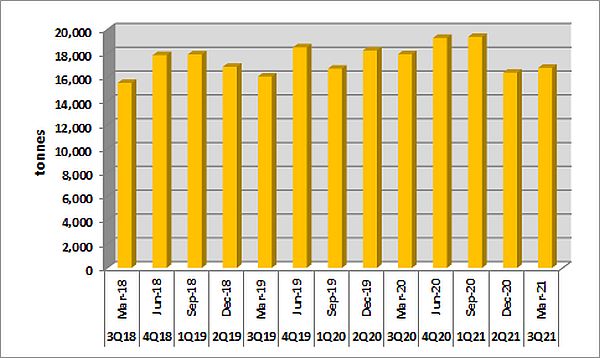

The DeGrussa (Sandfire’s interest 70%) and Monty mines in Western Australia are Sandfire’s producing sites. As Members can see from the above table, copper production fell by 6.3% year-on-year (yoy), to 16,803 tonnes of copper. The following chart shows quarterly copper production:

Source: Sandfire Resources

A fall in the copper grade of milled ore to 4.6% copper compared to 5.0% from a year earlier was the key driver of the result. A partial offset was the reported rise in milled ore throughput by 3.4% yoy, to 395,671 tonnes on improved efficiencies. Both the DeGrussa and Monty mines deliver to the same processing plant.

Copper guidance for 2021 remained unchanged with a forecast in the range of 67,000 tonnes to 70,000 tonnes. A standout feature was Sandfire indicating that it expects copper production to come in toward the upper end of its 2021 guidance band. For 2020, Sandfire produced 72,238 tonnes of copper.

Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.